Your Team Slide Sucks (Here’s How to Fix It)

Every founder thinks their team slide is fine until an investor glances for five seconds, yawns, and swipes left.

In my last article, I went into detail about creating an awesome teaser pitch deck and this article will expand on the all important team slide.

The team slide in your teaser pitch deck isn’t just a box ticking exercise showing names and photos. It’s your chance to clearly show why your team is uniquely positioned to dominate your market and win where others will fail. This slide will heavily influence whether investors take a meeting or not…. Stuff this slide up and you’re dead before you start.

Why This Matters

Your pitch deck is your passport to funding. The team slide is your visa stamp. Top early-stage investors consistently say the number one consideration for investment is the founding team. But Aussies suck at selling ourselves. Master this and you’ll stand out. Investors back teams before ideas. Brutal but true.

How to Build a Killer Team Slide

✅ Slide Heading → Use the Team slide heading to summarise why your team is the best in the world to win.

✅ Use Punchy Headlines → Highlight achievements, not titles. (“Scaled sales 10x at Canva” beats “Head of Sales”).

✅ Cut the Crap → Three bullet points per team member max: relevant skills, quantified wins, proven resilience.

✅ Show Causality → Clearly connect your team’s past wins to why you’ll succeed in your chosen area.

✅ Quantify Outcomes Clearly → Numbers matter. Contextualise achievements (e.g., “$1.6m ARR growth in 2 years”).

✅ Lead with Logos Smartly → Only use logos if clearly tied to specific, quantified achievements and they contribute to the overall story.

✅ Show Resilience → Startup life is tough. Show you’ve consistently overcome challenges.

✅ Strategic Advisors Sparingly → Include advisors only if they genuinely add credibility and are active. Otherwise, they just dilute your message.

✅ Non-Management Aren’t Important → Junior and mid employees are unlikely to move the needle for investors for your teaser deck and they distract from the main star of the show which is you and your co-founders.

✅ LinkedIn → Add each person’s LinkedIn and make sure all of your LinkedIn’s are up to date.

✅ Connect the Dots → Don’t imply things, make it explicit. Don’t get investors to read between the lines as they don’t have time.

✅ Team Is Oh So Important → The earlier your startup is, the more your team slide matters and should be closer to the start of your teaser pitch deck.

💡 Need Guidance on Raising Capital?

If you're exploring funding options and would like insights or support, feel free to reach out to Warwick Donaldson here on LinkedIn or here via our website.

Slide Examples Analysis

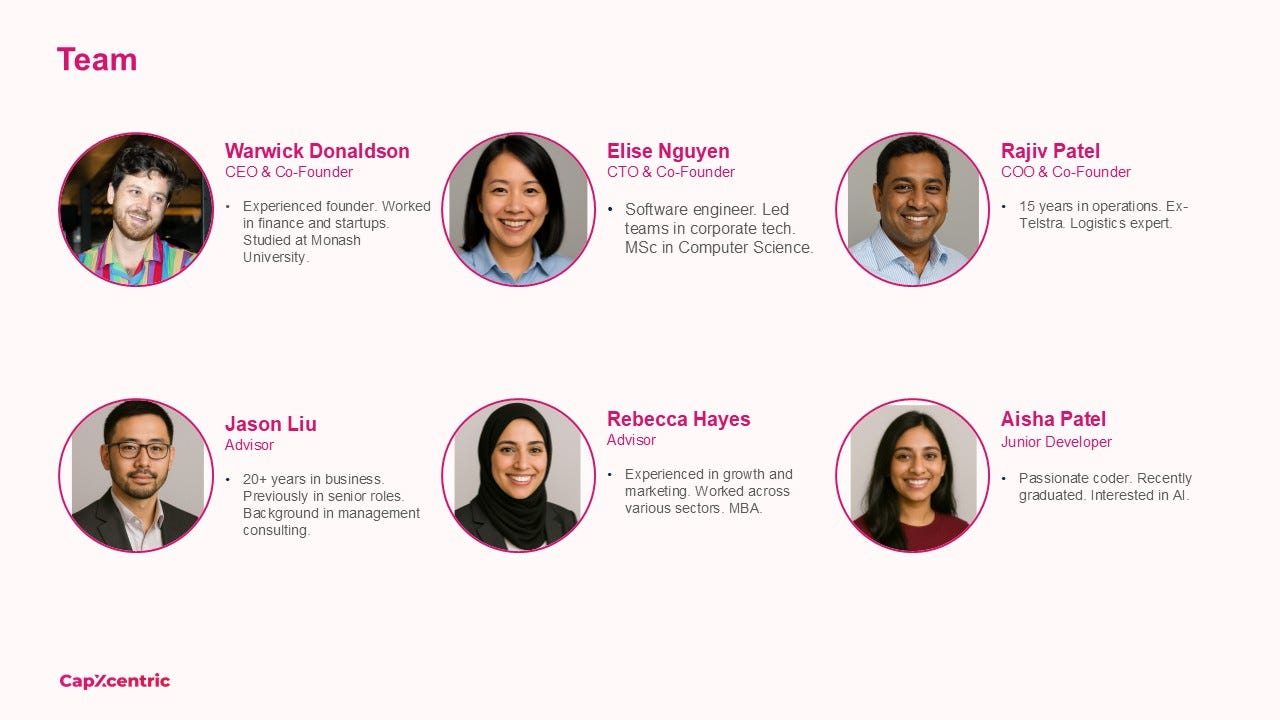

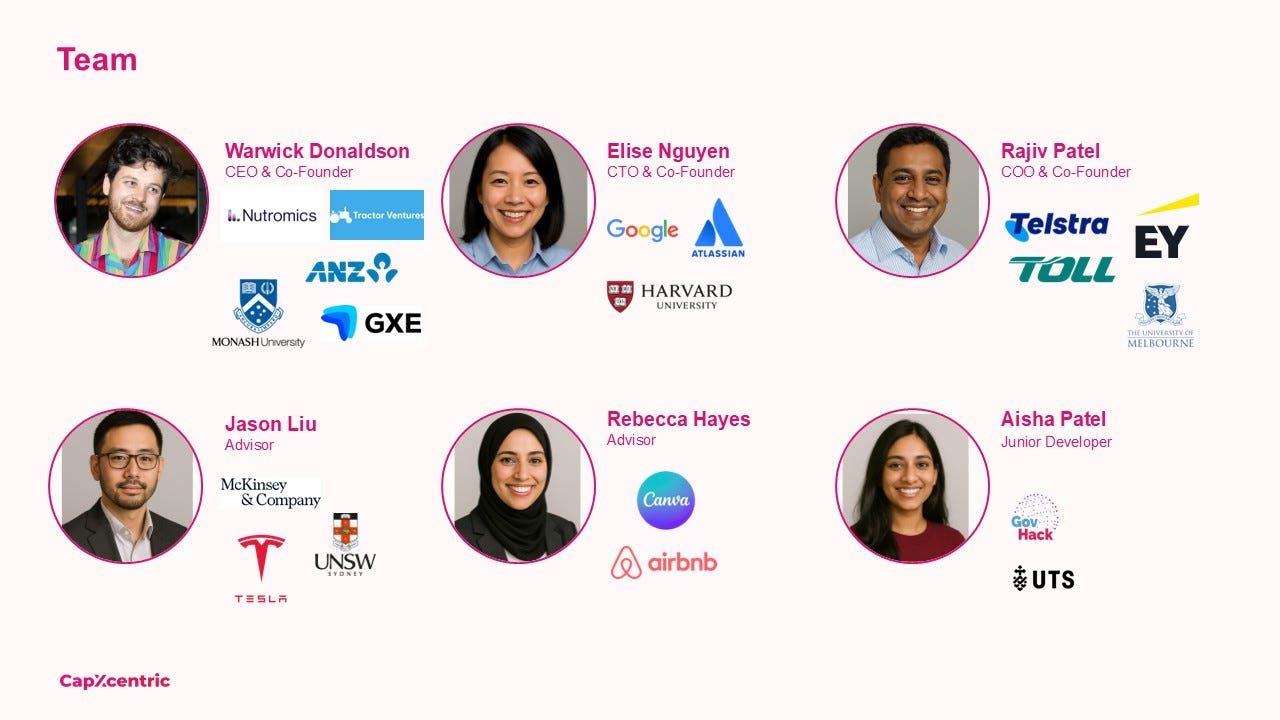

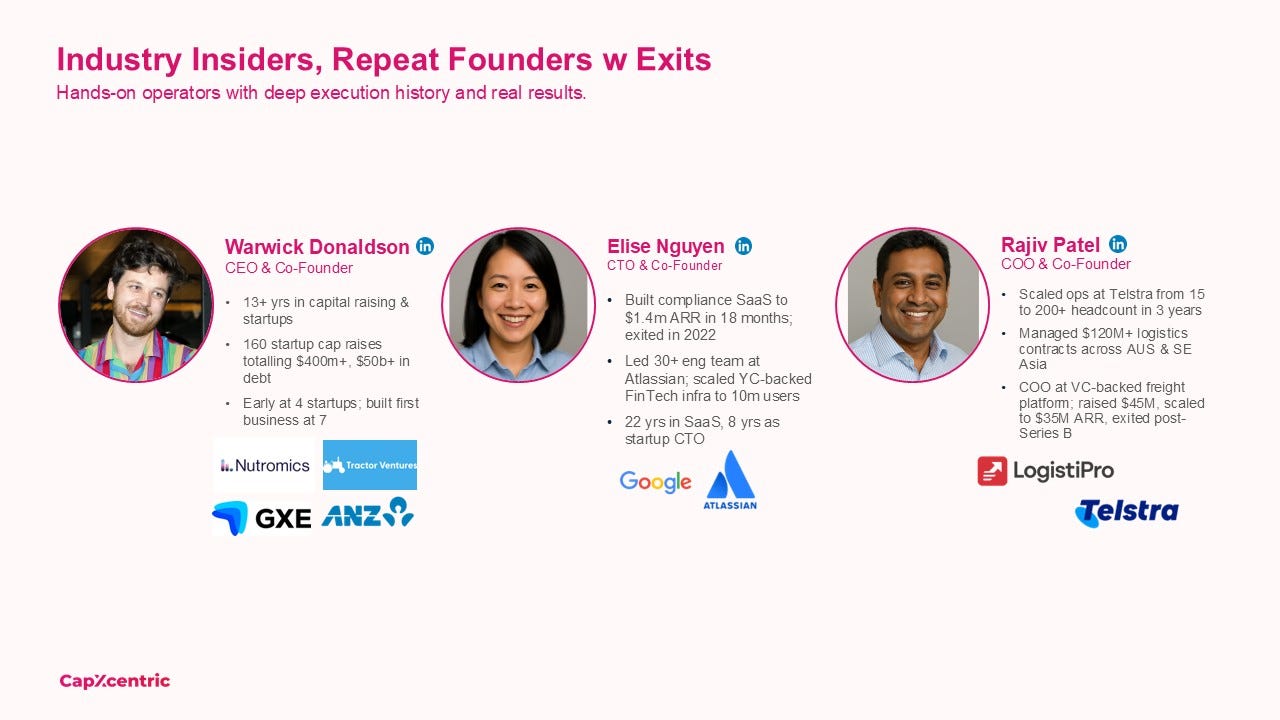

Below are three common team slides that I see in teaser pitch decks.

This is a poor slide → Generic details, lacks outcomes, no unique positioning, only uses “Team” for slide title.

This is a poor slide → Only logos which say nothing! Working at Canva or studying at UNSW doesn’t mean you’re a great founder that will smash your competition and build a generational company.

Now, this is an excellent slide → Clearly quantified outcomes, unique expertise, consistent resilience, and strong narrative alignment.

Need Help Navigating Your Capital Raise?

Check out some of my most-read articles that break down the capital raising process for Aussie founders.

📚 Raising Capital 101

🧠 Understanding Investor Mindsets

The Investor Traction Myth: Why Slow Replies Mean No Interest

The Investor Mindset: Why Rejection is Normal & How to Find the Right Startup Investors

First Investor Meeting? Questions Aussie founders should ask startup investors

⚠️ Avoiding Common Pitfalls

Pre-Money vs Post-Money SAFE Notes in Australia: What Founders Need to Know

Australian Startup Red Flags That Investors Watch Out For: What You Need to Know

📈 Advanced Capital Strategies

💡Not sure where to start? Check out the article on The Startup Capital Raising Process it’s a founder favourite.

Contrarian Takes

Investors don’t care about your entire team equally. 90% is about the CEO and core founders and management team.

Ruthlessly amplify your credibility.

Many investors still fall victim to confirmation bias-they irrationally favour credentials like Harvard or Google experience. While it’s nonsense, research investors to try to identify their biases and cater to them if needed. Consider if you want money from someone who thinks like this, as it could affect their future value to your startup.

Conclusion & CTA

If your teaser pitch deck isn’t securing second meetings, rebuild it now. Use my last article “You Probably Have the Wrong Pitch Deck” to guide you.

Remember - Early startup investors invest primarily in amazing teams so don’t be afraid to tell them why you are an amazing team. Join the dots. Don’t leave anything unsaid.

Your Thoughts?

Does this hit for you? Let me know by commenting below, liking the article, replying to this email or hitting me up on LinkedIn.

Hi - I’m Warwick Donaldson—capital raising expert, and unapologetic advocate for Australian startups. Across my career, I’ve worked on 160+ equity raises totalling over $400m. I pride myself on helping early-stage founders secure funding, avoid costly mistakes, and build investor confidence.

If you’re a founder looking to raise capital, attract top-tier investors, and build a generational business—then hit me up for a chat.

Disclaimer: Excentricity Pty Ltd, trading as CapXcentric (ABN 42 679 978 959, AFS Representative No. 001311296) is a Corporate Authorised Representative of True Oak Investments Pty Ltd (ABN 81 002558 956, AFSL 238184). The information provided in this article is intended for companies and startups and is not directed towards investors. Any statements or representations are general information only and do not take into account your personal objectives, financial situation or needs. Readers are advised to have regard to their own circumstances and consider seeking specific advice from a professional adviser before making any business decisions. No representations are made as to the accuracy, completeness, or reliability of any information provided in this article. Readers use the information provided at their own risk.